If you are due a tax refund from your current year tax return, the IRS states that you should generally wait until you receive your refund before filing your amendment if you are claiming an additional refund. How long do you have to file a tax amendment? The IRS does not support direct deposit for an amended return, so they will mail a check if you are owed a refund.

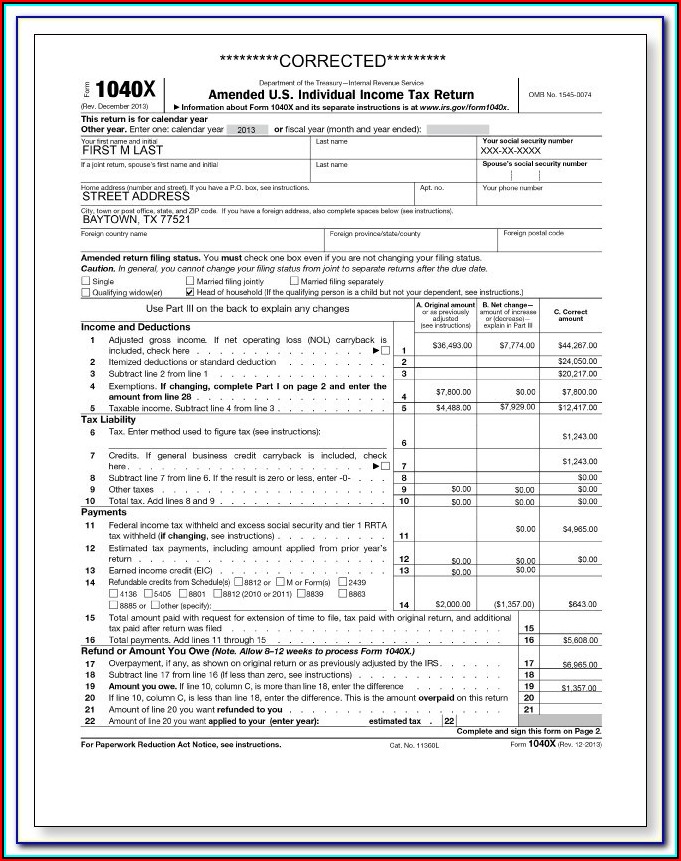

State contact information is at the bottom of the respective state page.Ĭurrently, the IRS processing rate for mailed and e-filed amended returns is up to 16 weeks. Check if you might need to file a state tax amendment as well or first contact your state tax agency. Generally, if you amend your federal return, then you should amend your state return as well see state tax amendment forms. Important eFile Tax Tip: Your state tax return may be significantly impacted by changes you make to your federal income tax return. If you did not file your current Taxyear tax return via, you can prepare, sign, and print Form 1040-X:įor Tax Years 2019, 2020, 2021 2022, complete and sign this Form 1040-X via our online editor, then print and mail your amendment to the IRS.įor Tax Years 2018, 2017, 2016, 2015, and before, complete and sign this Form 1040-X via our online editor, then print and mail your amendment to the IRS.See below to learn when to file and when not to file an amendment. The return in question has to have been accepted by the IRS and/or state. Generally, you must file an IRS individual income tax amendment form and/or state amendment if you need to add more information, remove information, or make general corrections to an income tax return you already filed or e-filed.Tips regarding your federal and state amendment for all tax years: It does not cost anything to fill in and mail a tax amendment.Īlready filed your amendment? You can check your amendment status for the current tax year and up to 3 prior tax years here: Previous year amendments can also be completed for free, but will need to be mailed in as the IRS does not accept e-filed returns for years that have passed.

#Turbotax 1040x amended return 2016 how to

Step by step instructions on how to file a current tax year Tax Amendment. Tax amendments for state tax returns can be completed from the respective state page(s). You can prepare your amendment from your account, but you will need to do this by October 16, 2023. Amendment preparation from your account is not available for previous year tax returns.

#Turbotax 1040x amended return 2016 free

We make it easy and free for you to prepare your federal amendment for the current tax year if you have e-filed your current Taxyear IRS Return on. This is to make sure that the IRS does not make the adjustment on their end for you and to assure the difference is applied to your amendment. It is best to file your amendment in the filing season it was due we also recommend waiting to receive your refund or until your tax payment has processed. You should file an amendment as soon as you become aware of a change that is needed on your return. Find out about state tax amendments and previous tax year amendments. If you need to amend your federal return, you generally should amend your state return as well. If you did not use for your IRS accepted return, you can complete the Form 1040-X (for tax years 2019 and later) and Form 1040-X (for tax years 2018 and before) Then print, sign and and mail in the form to the IRS. See how to prepare and file a current Taxyear IRS Tax Amendment on. If you have e-filed a current Taxyear Tax Return via, you can prepare your amendment directly from your account-amendments are free on.

In order to make changes, corrections, or add information to an income tax return that has been filed and accepted by the IRS or state tax agency, you must file a tax amendment to correct your return(s). Important! As of June 2023 the IRS National Taxpayer Advocate reported that the IRS is behind on the processing of amendments, and can possibly take up to 7 months to process. See how to file a free amendment for your current Taxyear Return.

If you filed your IRS accepted current Taxyear return on, you can prepare your 1040-X in your account and print and mail it to the IRS for free. An IRS tax amendment for the current Taxyear can be prepared on at no charge see how to amend a tax return for any tax year here.

0 kommentar(er)

0 kommentar(er)